Learn more about green finance in relation to real estate and how you can qualify for green and sustainable financing conditions with greenpass while savinging money directly in this blog post.

Green and sustainable financing

Blog Articles

Your all-round carefree package for climate-proof real estate

What do human health and real estate climate proofing have in common?

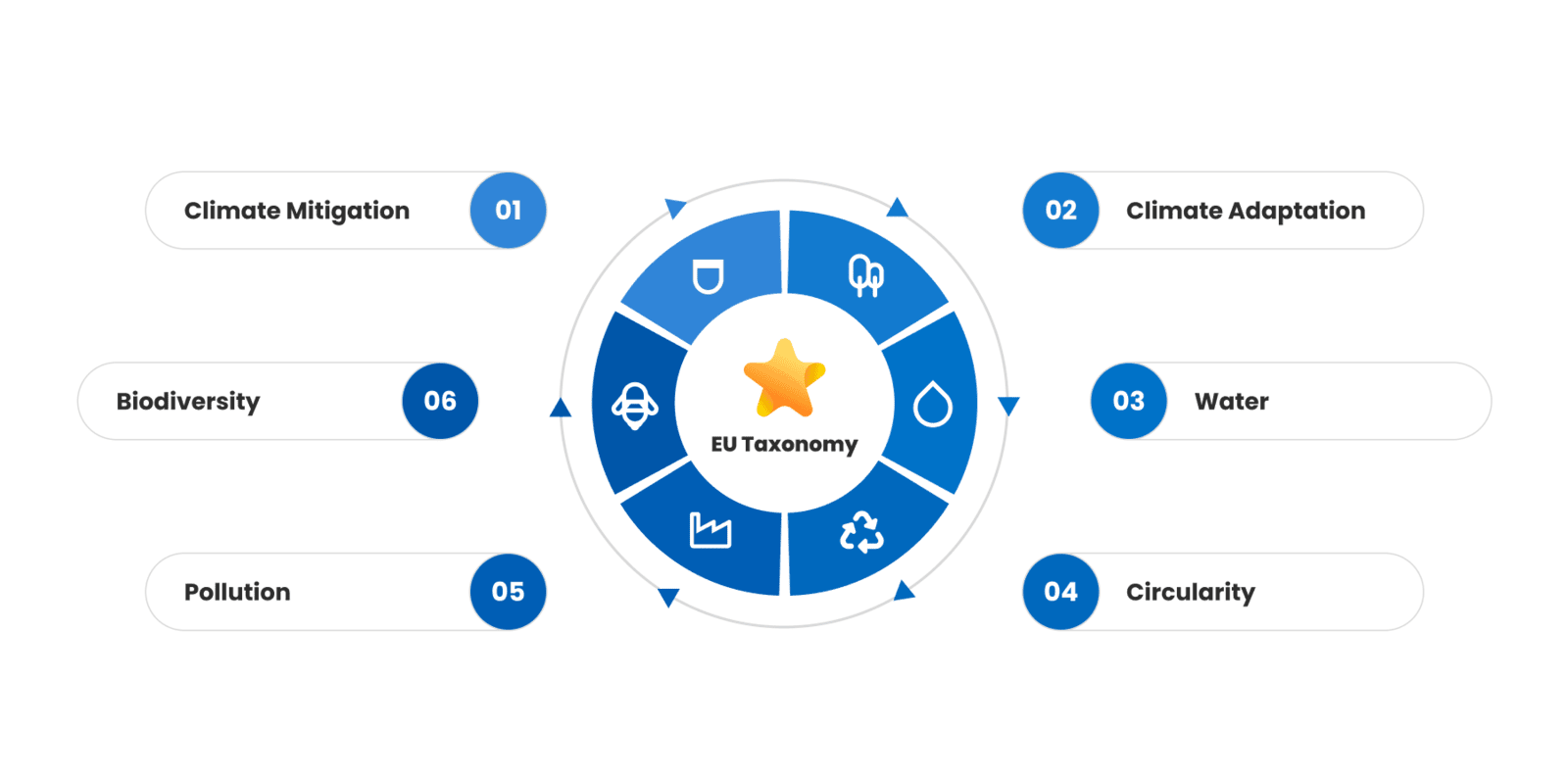

What defines 'green'?

Obtain your confirmation of conformity with the EU Taxo Check

Get your green financing now with the official greenpass

Calculate your direct savings

Similar posts

More relevant content on related topics for you